Exxon, Chevron generate maximum cash for one year Coronavirus pandemic News

[ad_1]

Crude prices and demand for chemicals used in plastics more than offset the refinery’s losses as North America’s largest oil explorers reported results for the first quarter on Friday.

Exxon Mobil Corp. and Chevron Corp. created the freest cash flow for more than a year as economies around the world emerged from foreclosures, boosting energy demand.

Gross prices and demand for chemicals used in plastics more than offset losses from oil refining, the results of North America’s largest explorers showed results in the first quarter on Friday.

Despite meeting Wall Street earnings expectations, Chevron shares fell 2.4% to disappointed investors who were anticipating a recovery in stock purchases. Although Exxon’s deep refining losses were driven by chemical gains, the stock fell 1.7%.

All supermarkets are making money by grossing more than $ 65 billion a year from $ 65 million a barrel, driven by rising energy demand, pulling the economy out of the pandemic and holding OPEC in line with large supply increases. BP Plc, Royal Dutch Shell Plc and Total SE achieved higher-than-expected US members.

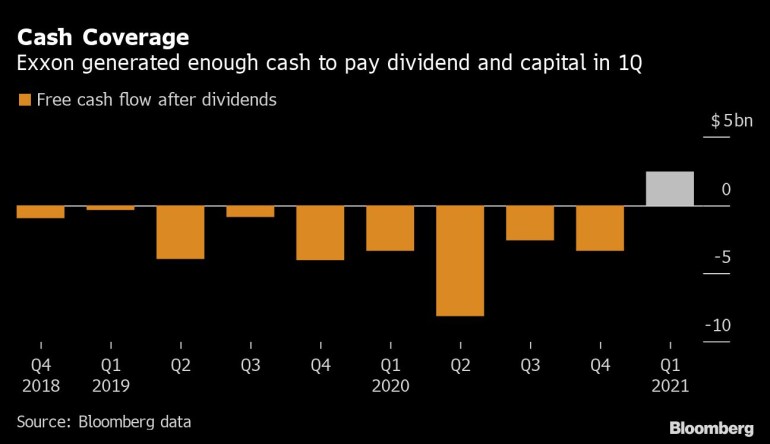

Exxon had more than $ 6 billion in free cash flow enough to cover its mammoth dividend. This is the first time the oil giant has been able to do so since the end of 2018. Chevron earned $ 3.4 trillion in its first quarter, the age of funding lately. the dividend has increased, which is a closely guarded metric for large oil supermarkets.

For both companies, the main driver of cash flow growth was large spending cuts, with lower-risk efforts such as shale drilling, which favored more expensive megaprojects. Exxon cut capital spending by more than half, 43% less than Chevron a year ago. Both have no plans to increase spending given the high oil prices, a sign that the discipline is maintaining it for now.

Exxon earned 64 cents in the first quarter, beating an average estimate of 61 cents by analysts in a Bloomberg survey. Most of them won the oil exploration and drilling divisions, but even the highest chemical prices picked up a headwind, helping to offset the losses in the deadly Texas storm in February.

Exxon’s changes to last year’s unprecedented loss chains will help it regain its ability to maintain the S&P’s third-largest dividend and grow even further, with CEO Darren Woods moving to Wall Street. Unlike European rivals Shell and BP, Exxon did not cut payments last year, but the decision had a cost: Debts rose 44% to nearly $ 68 billion. Exxon has cut debt by about $ 4 billion this quarter.

Chevron’s earnings adjustment per share was 90 cents, according to a statement, in line with the average of analysts ’forecasts. The results for the entire sector may indicate the worst for the double threat of tightness around the world and the killing of the Covid-19 blockade request.

Among the enlightening perspectives, important challenges remain. The U.S. Chevron refining network lost money for the third time in four quarters, and overseas fuel production plants reduced gross processing by 16% to meet the anemic demand for transportation fuels.

Both companies cited the negative effects of the deadly winter storm Texas suffered in mid-February.

Chevron wants to start buying shares, but has not refused to give them a deadline, confirming the position announced in March.

“Looking ahead, we expect to begin a share buyback through the oil price cycle when we are confident that we will maintain a buyout program for several years,” Chief Financial Officer Pierre Breber said in notes prepared for a conference call. analysts this morning.

[ad_2]

Source link