Erdogan says Turkish interest rates will continue to fall | Recep Tayyip Erdogan News

[ad_1]

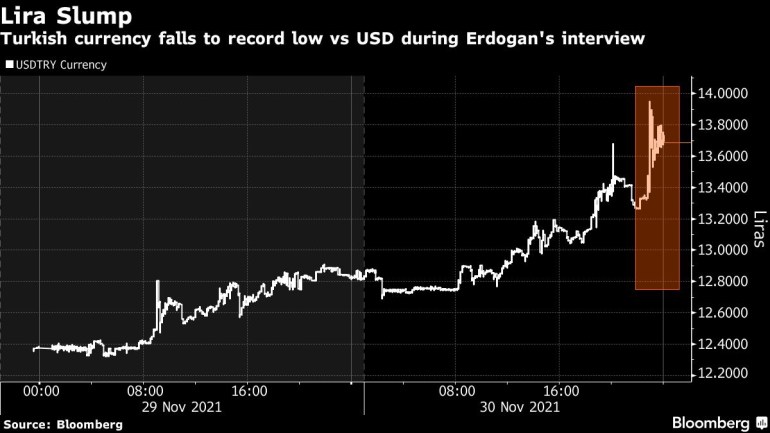

Cheaper cash will boost manufacturing, create jobs and slow inflation, Turkish President Recep Tayyip Erdogan said in a television news interview. The pound extended losses after its notes fell 8.1 percent against the U.S. dollar.

Turkey’s interest rates will continue to fall, said President Recep Tayyip Erdogan, freeing himself from short-term dependence on foreign currency and opting for an economy that grows in local production and exports.

Cheaper money will boost manufacturing, create jobs and slow down consumer inflation, which is now four times higher than the official 5% target, and will eventually strengthen the currency, Erdogan said in an interview with state broadcaster TRT on Tuesday.

Turkey will not try to attract capital flows or investments that can be quickly withdrawn from its “hot money” economy, Erdogan said. His commitment put the Turkish central bank in an awkward position after monetary policy makers said they would evaluate ending interest rate cuts. However, the Turkish lira has lost almost 28% of its value since the bank began its current mitigation cycle in September and the reference rate fell by 4 percentage points to 15%.

“Our country has come to break this vicious circle, and there is no turning back from here,” Erdogan said.

The lira extended losses after Erdogan’s statements, falling 8.1% against the U.S. dollar. It was 6.4% lower at 13.7058 per US dollar from 23:07 in Istanbul.

Price blows

Erdogan unveiled his latest policy stance just over a week ago, pushing for lower interest rates to boost growth and boost his popularity before the 2023 vote.

Encouraging lower borrowing costs is hardly new to the Turkish president, as cheaper money slows inflation because the proposal challenges ordinary economies. Encouraging credit-driven growth before the election has served him well in the past.

With the growing impact of this policy, the growing income gap, and the damage caused by Covid, the potential social costs are much higher this time around. The price cuts resulting from the fall of the lira are making life more expensive in the 84 million nation.

Following old policies based on “false” premises would exacerbate these problems, Erdogan said.

“The policy of high interest rates imposed on us is not a new phenomenon,” he said. “It is a model that destroys domestic production and makes structural inflation sustainable by increasing production costs. We are ending this spiral. ”

The government is working on two aid programs to alleviate short-term volatility aimed at creating 50,000 new jobs, the Turkish leader said.

Private companies will receive £ 50 billion ($ 3.7 billion) in new loans as part of one of the programs supported by the Credit Guarantee Fund. Interest rates on loans will be 7 percentage points lower than market levels, and this year will see a 10% increase in Turkey’s gross domestic product, Erdogan said.

[ad_2]

Source link