New business models, great opportunity: Financial services

[ad_1]

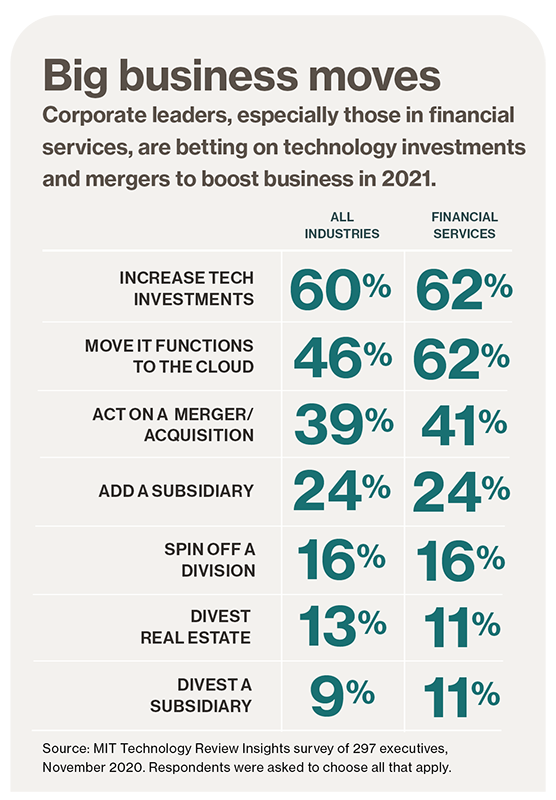

More motivated than ever, organizations in all industries are ready to reduce costs that do not result in a net return on investment. It is therefore not surprising that survey respondents place computer projects (all very measurable) as a priority in the 2021 plans. Among financial services organizations, 62% are looking to increase technology investment and another 62% expect to take IT and business functions to the cloud, compared to 46% in the industrial sector. In a recent report, Nucleus Research found that cloud deployments provide four times the return on investment as local deployments do.

Planning beyond the pandemic

The American Guardian Life Insurance Company is an example of a progressive cloud receiver; many of its basic financial systems are now being taken to the cloud. The insurer was motivated to do this: an internal study found several options, including sufficient data management, the need for low-level data to get better analytics, lack of system integration, and problems with manual unification. “These pain points helped create the need for a new system,” says Marcel Esqueu, assistant president for the transformation of the Guardian’s financial systems. “We looked at going to the cloud five years ago, but we didn’t think it was ready.” Now the company considers them mature enough to support the advanced functionality that cloud services require.

Financial institutions are also exploring mergers and acquisitions as a way beyond the survival of the pandemic. In fact, according to a Reuters report, these agreements rose by 80% in July 2020, compared to the previous fiscal quarter in August and September, when they raised a whopping trillion dollars in transactions. In the MIT Technology Review Insights survey, 41% of financial services executives reported that their organizations are engaged in a business merger or acquisition or will do so next year.

“People have realized that they need to be strengthened to create stronger and better-equipped businesses to meet the forward-looking world,” Citigroup CEO Alison Harding-Jones says in a Reuters report.

Mergers and acquisitions have long been an opportunity for organizations to expand their core business or even specialize in emerging technologies. For example, while many financial institutions are buying business software with artificial intelligence (AI) capabilities, Mastercard bought a Canadian AI platform company called Brighterion in 2017 to provide “a critical mission of intelligence from any data source,” says Gautam Aggarwal, regional head of Mastercard Asia-Pacific technology (CTO). The company first used Brighterion’s technology to detect fraud, but is now embarking on a credit score, money laundering and the company’s marketing effort. “We actually took Brighterion and we didn’t apply it to the use case of the payment but,” says Aggarwal.

Business change, both inside and out

In fact, organizations have had to innovate and respond quickly to survive in the hidden economy. In the survey, 81% of industry organizations have evaluated new business models in 2020 or plan to launch them next year. Among financial service organizations, improving the customer experience is key, with 55% reporting that they are improving the experience they offer their customers, compared to 35% in the industry.

That’s true Jimmy Ng is the chief information officer of the Singapore DBS Bank team (CIO). When physical offices were closed down, DBS customers – like other banks around the world – did so online. Some of them did it only because they did so. “The question is whether this group of people will continue on the digital channel.” So DBS is looking at ways to keep customers who prefer pre-service, such as augmented and virtual reality and a 5G mobile network, exploring technologies that enable fast connections. “How do we enable customers to travel joyfully in this remote way?”

Download full report

This content was created by Insights, a custom content from the MIT Technology Review. It was not written in the editorial board of the MIT Technology Review.

[ad_2]

Source link