Crypto Return: Bitcoin Bounces After Wild Sale | Crypto News

[ad_1]

Black Friday hit cryptocurrencies last week when Bitcoin posted its toughest day in two months. But things were better by Monday.

Bitcoin will make a return on Monday along with other more dangerous assets to return from Black-Friday lows.

The largest digital asset rose 3.4% in the session to trade at about $ 58,266. Other currencies also posted snap-backs, with the Bloomberg Galaxy Crypto Index up 5.5% at one point. Alternative coins like Polkadot and Dogecoin were also won.

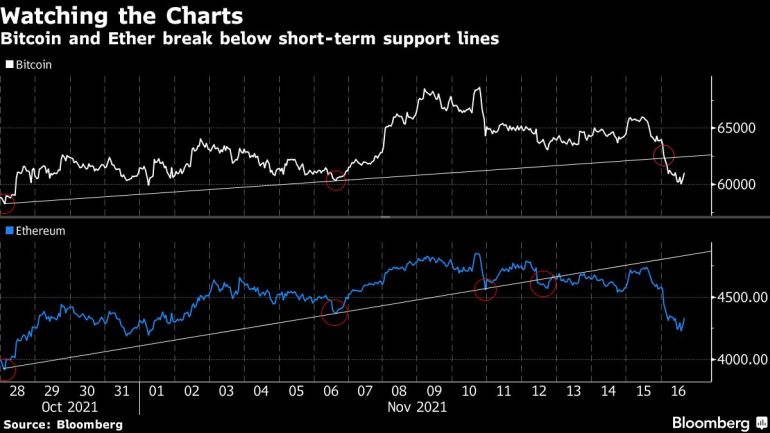

A wild sell-off on Friday fled investors from some of the most risky assets, including cryptocurrencies, as Bitcoin posted its worst day in two months. The accident occurred after a new variant of the coronavirus called omicron was identified in southern Africa, and experts are now trying to understand it. The decline in the session saw Bitcoin fall 20% below its previous record in November, which shows that for many strategists the currency tends to follow the movements of the wider stock market closely.

“Bitcoin stands out as an asset for risk / risk elimination,” said Matt Maley, Miller Tabak + Co’s chief market strategist.

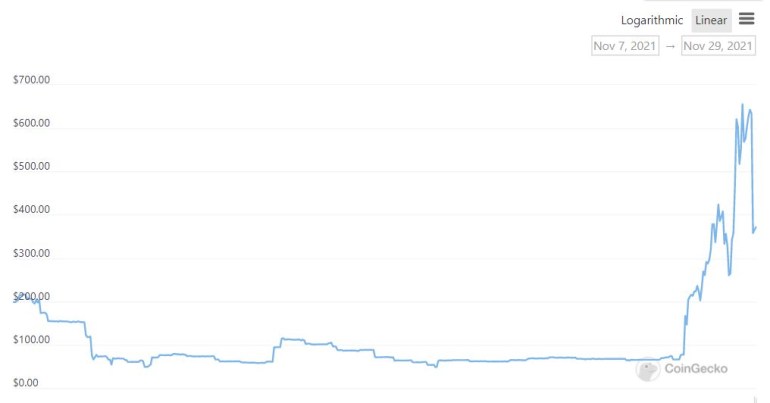

Meanwhile, in a development that is a key kryptonite, a coin called Omicron fell and was later recovered as news of the eponymous variant spread. Although little is known about the coin so far, data from CoinGecko.com show that it has been around for a few weeks and its market capital is around $ 370 million.

Bitcoin has come under pressure since it hit a record high of nearly $ 69,000 on Nov. 10 with excitement over the first U.S. exchange-traded fund linked to the future of digital assets. But a number of factors have affected profitability since then, including higher regulatory risks and many tokens that have been created very quickly in a short period of time. Maley says recent Bitcoin moves also show that if the Federal Reserve were to remove the stimulus more aggressively next year, cryptocurrencies could become weak.

Fiona Cincotta, senior analyst at City Market financial markets, says Bitcoin tends to act like a more risky asset that tracks stock market movements, but that relationship isn’t as strong, for example, when it’s warmer. -expected inflation prints arrive, Bitcoin may hold up well in those periods.

“So I think Bitcoin plays as a more risky asset and continues to rise higher in the stock market, but there are also cases where that’s not necessarily the case,” he said over the phone. “It has other contributing factors that drive it.”

Now, nervous traders are turning to technicians again to find out where certain cryptocurrencies can go. On Sunday, Bitcoin bounced back from the 100-day moving average, a trend line in the medium term. Meanwhile, on Monday, Ether pulled out its 50-day moving average, which many graphic viewers see as an upward trend.

However, Peter Tchir, head of macro-strategy at Academy Securities Inc., says he was surprised by Friday’s sell-off of Bitcoin based on coronavirus news. To him, it seems that there is a group of aggressive risk takers who own the cryptography and probably also own some high-tech tech stocks.

“If they move in tandem they may be forced to sell one or the other,” Tchir said. “Rising Bitcoin relieves that pressure. When we had what seemed like a likely rally, everyone dismissed omicron fears, we can see that it lasts.

[ad_2]

Source link