Global ports are linked to the delay in the blockade of the Suez Canal

[ad_1]

Earlier this month, delayed cargoes due to the landing of the container ship on the Suez Canal began to reach ports around the world, and workers such as Singapore-based carrier Harris are making efforts to delay the delay.

Like a lock was removed and were ported hundreds of times by Egyptian port workers delayed vessels through one of the most crowded waterways in the world, Harris “didn’t have many orders. . . to collect ”. But now, “we can see more demand coming in,” he said, warning that his company would reopen the canal and make a leap in work in the coming weeks.

Singapore is the most common destination for container vessels stuck in Suez’s queue – among the nearly 100 delayed container vessels, about 20 percent were in the center of Asia according to supply chain visibility group project data44.

But it is by no means the only port that is increasing traffic – which puts new pressure on global supply chains that were already struggling to deal with the problems caused by the coronavirus pandemic.

Keith Svedsen, chief operating officer of APM Terminals, the world’s third-largest container terminal operator, said the main impact of Suez’s disruption this week was felt in Europe, with “pressure points” in Spanish and Northern ports.

Terminals in Malaysian, Omani, Moroccan and Spanish ports have been working “as an emergency or in capacity” to deal with large volume increases as carriers dumped cargo to be routed to other ports, he added.

The Belgian Port of Antwerp expects the rapid activity to begin this week, which will last until June, although it is said to be able to cope without much delay.

The rival in Rotterdam tells a similar story. “The end result is we’re in the military,” said Leon Williams of the Rotterdam Port Authority. “Ships should wait longer to unload cargo, but it’s not a crisis.”

PSA, one of the two main operators of Singapore’s commercial port terminals, said the “first wave” of ships from Sweden had reached the island’s shores, adding that their cargo had been “properly managed” thanks to “detailed pre-planning”.

While European and Asian ports are keen to deal with congestion, the increase in traffic has created problems crossing the docks. Trucks and railways that carry goods to or from ports have become bottles in ports like Gothenburg in Sweden. “The whole system is focused on a normal week,” Svedsen said.

Importers in the UK said they would need to wait 10 more weeks for goods to stay in line with Suez and initially arrive, partly because there are limited slots for trucks in warehouses.

Meanwhile, the delivery times of eurozone suppliers are the longest at 23 years, according to the IHS Markit Purchasing Managers ’Index, an extensive analysis of business activity; as a result, inflation in factory entry costs in the eurozone has risen to a one-decade high.

The great turmoil in the already deployed global logistics networks has increased costs for exporters and is tightening production lines.

Global shipping he has struggled with chaotic schedules for months, changes in consumer demand for goods, as well as factory closures and Covid containment measures that have slowed port operations. As a result, empty containers have been missing where they are needed since last fall.

In February, the Singapore PSA said it was “increasing additional capacity and resources” as “ship calls and container volumes increased”.

Shipping companies are desperate to avoid empty containers from Europe as soon as possible more adherence.

Some have resorted to buying new boxes. This month, Hapag-Lloyd invested $ 550 million to buy 150,000 vessels of 20,000 ft. Rolf Habben Jansen, Germany’s chief transport officer, said it was expected to return to pre-pandemic service levels by the middle of the third quarter, helping Covid-19 release restrictions in Europe.

“We see a bit of light at the end of the tunnel. We could do it without an incident in Suez, “he said.” The boxes will be tight in the coming weeks. “

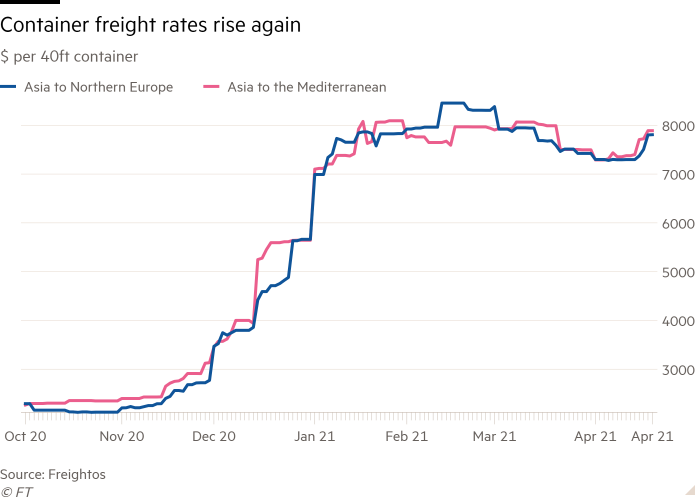

Shortage of containers has risen freight rates from Asia to Europe, which began to peak in March and began to fall until the blockade of Suez. The cost of a 40-ft container has risen 7 percent to $ 7,807, according to the Freightos booking platform, 450% higher than a year earlier.

Alan Murphy, CEO of Sea-Intelligence Consulting, said European exporters in the face of higher prices As a result of the rush to return containers to Asia, especially for low-value products and scrap goods.

“If you want to export anything from Europe, you will have difficulty finding containers and space without paying very high freight rates,” he said.

Higher prices are not the only challenge. Pawan Joshi, executive vice president of product management and strategy at E2open, said his platform manages 26 percent of the world’s shipping reserves, which would result in shortages of supply chain components.

Citing the example of computer chip crisis which has recently forced some car manufacturers to reduce production. He said earthmoving equipment, generators and air conditioning are among the production lines at risk of similar disruptions.

“The long-term silent break comes from making other products,” he said. “If you put that on [against] in the background of the semiconductor crisis, then we hope to see – not immediately because there is an inventory [at the moment], but in the coming weeks “.

Additional report by Valentina Romei

[ad_2]

Source link