Thailand faces severe COVID outbreak, economic risks increase Business and Economic News

[ad_1]

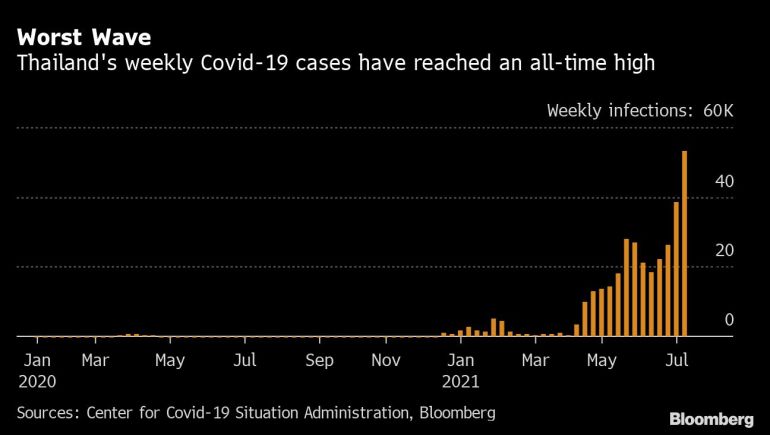

Thailand is at risk of fueling a decade-long unemployment rate and domestic debt by imposing blockade-like measures to contain Covid’s deadliest outbreak.

The larger area of Bangkok, which accounts for about 50% of Thailand’s gross domestic product, will close shopping malls, spas, massages and beauty clinics for at least two weeks from Monday. Mandatory rules for working from home for most government employees, honest night robes and home travel will hurt traders, airlines and restaurant operators, with some Covid restrictions already in place for more than a year.

Thailand is tightening restrictions to stop the spread of the Covid delta contagious variant, which has also increased its intentions to open borders in cases from Indonesia to Vietnam. The latest measures could delay the recovery of the Thai economy after more than two decades and could undermine the goal of welcoming tourists introduced by Prime Minister Prayuth Chan-Ocha in mid-October.

“There will be an increasing economic blockade with each blockade, even if the length of the blockade is the same,” said Maria Lapiz Maybank, CEO of Thailand’s Kim Eng Securities. “That’s happening because a lot of companies are already ending up linking up after so many months of reduced revenue and high stability costs.”

Lapiz says Thai houses are hitting hard and corporate profits are falling, while Singapore-based economist Radhika Rao of DBS Bank Ltd. is “increasing downside risks” to the forecast for Southeast Asia’s second-largest economy.

Here’s what Covid’s latest cuts mean for the Thai economy:

GDP growth:

Even before the latest measures were announced, the Thai central bank saw a “significant downside risk” to 1.8% economic growth this year, saying a long outburst would squeeze business liquidity and hurt employment in the services sector. The economy expects Covov to return to previous levels only in early 2023 if herd immunity is delayed by the end of next year.

On Monday, the Bank of Thailand said it could cut its 2021 GDP forecast to worsen Covid’s outbreak, and will closely monitor the situation to see if additional policy measures are needed.

“It is projected that due to the availability of the vaccine this year and the economy would breathe a sigh of relief, the economic impact is likely to spread until it reaches critical mass,” said DBS Bank Rao. “Bounce expectations depend on public spending and exports, while weak consumption is clouding private sector investment trends.”

Unemployment, Debt:

The unemployment rate is likely to rise by 1.96% at the end of the first quarter, the highest level since 2009, which is likely to see more people lose their jobs due to a long run and a halt in business. The success of the urban service industry can drive more people to agriculture, a trend seen in last year’s national shutdown.

The Bank of Thailand last month announced a “W-shaped” recovery in the labor market, slower than past bounces, as it calls for deep scars in the fragile services industry.

Thailand’s household debt, which reached a height of 90.5% of 18-year GDP, may be exacerbated by the loss of jobs and income due to tougher cuts. This will seriously affect consumer spending, a key driver of economic growth.

Vaccines:

Thailand has distributed about 12 million vaccine doses, enough to cover about 9% of the population, placing the country behind more than 120 other territories in inoculation rates. The government needs to increase vaccines and spend most of the planned 500 billion baht loan plans “to ensure more quality vaccines than to harm affected groups and revitalize the economy,” according to Kampon Adireksombat, SCB’s Deputy Director of Securities. Investment Office.

“If we block vaccines without increasing them, new cases can be temporarily dropped before they go up again,” Kampon said. “We will be in an ugly cycle of blockages and compensation. That will hurt the economic outlook next year. “

Currency, Stocks:

Investors have already suffered a worsening pandemic in Thailand as the nation’s currency and shares have plummeted for four weeks in a row. Although the strong dollar has helped lower the baht to a 15-month low, this year the stock has suffered a net profit of $ 2.6 trillion this year from foreign investors.

Consumer goods companies, traders, companies, hotels and shopping center operators ’earnings could be hurt by a weak economy and ongoing cuts, while the baht could have a greater impact on the U.S. dollar.

“It is likely that foreign investors will avoid new high-risk markets including Thailand,” SCB’s Kampon said. “The baht will remain weak and the central bank will take steps to reduce excessive movements. But exports should be good, which should help the economy.”

[ad_2]

Source link