Economists predict a sharp rise in US interest rates by the end of 2023

[ad_1]

High inflation will force the Federal Reserve to raise US interest rates by at least twice by 2023, according to a survey of leading academic economists by the Financial Times.

The inaugural survey The initiative by FT and the Global Markets Initiative at the Booth School of Business at the University of Chicago shows a more potential path to monetary policy than stated by Fed Chairman Jay Powell.

Economists ’opinions are in line with the“ point plot ”of forecasts made by Fed officials as to when and how much rates should rise from around the current level to zero, as the U.S. economy pandemic bounces and inflation is long before the Fed’s average target.

Publication of the last point argument submitted shake through the markets earlier this month, politicians expected the expiration times to move forward, but Powell and other members of the Fed leadership he then intervened to emphasize that they would have the patience to maintain a very proper monetary policy.

The FT-IGM U.S. Macroeconomics Survey surveyed 52 academic economists, with the Fed’s main policy rate expected to be 0.50 percentage points higher by the end of 2023, as the graph indicates. A majority said the range of moves of this size or more is over 75 percent, and a large minority reaches 90 percent.

Three economists said it was a certainty.

The survey emphasizes challenge to send a clear message to the central bank about the evolution of its monetary policy stance. Powell warned that predictions of future rate hike points should be taken “with a grain of salt,” but other officials have begun raising the first rate for first rate hikes.

“As inflation rises and the economy improves, the pigeon pigeon differences between the federal open market commission will begin to reappear,” said Alan Blinder, who is vice president of the Fed in the 1990s and participated in the survey. “You’re watching now, and you’ll see more.”

Blinder said he planned to raise interest rates by 2022.

Respondents to the FT-IGM survey believe that Fed officials are the biggest driver of change in thinking during rate hikes, citing that it is a major factor more often than improving the U.S. labor market outlook or raising house prices.

This year consumer prices have risen beyond some of the highest estimates. Core PCE, the Fed-led inflation measure, was hovering at a rate of 3.4 percent year-on-year in May, the 29-year high as strong demand for goods and services improved the economy collided with full supply chain constraints.

The FT-IGM survey, which was conducted from June 25 to June 28 and will be conducted regularly throughout the year, shows that economists feel very well about the risk of high inflation. At the end of this year, the basic PCE medical forecast was 3 percent – the same forecast as the median official of the Faith.

But two-thirds of respondents said it is “somewhat” or “very” likely that this metric will be more than 2 percent from year to year by 2022. The median forecast for faith officials is 2.1. cents at the end of next year.

“It’s hard to think of a more pro-inflation environment,” said Stanford University economist Nicholas Bloom, who took part in the survey. “The Fed has been as aggressive as possible in promoting growth. Fiscal policy is very calm and there are supply constraints.”

Despite the “perfect storm” that Bloom has set up to raise consumer prices, it ruled out concerns that long-term inflationary pressures would be taken out of hand, at least not because the Fed is willing to act.

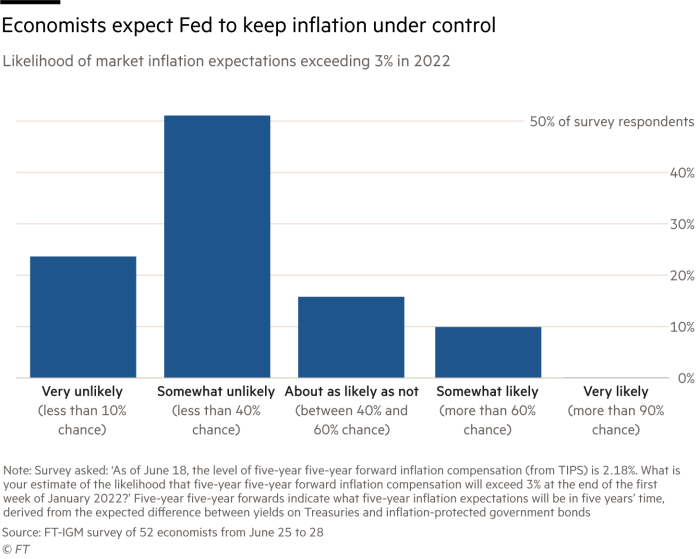

Three-quarters of respondents to the FT-IGM survey said it is unlikely that long-term market expectations for inflation will rise significantly by more than 3 percent early next year. Expectations are currently at 2.3 per cent long inflation.

“A key part of the Fed to maintain credibility is to respond to input data,” said another respondent, Harvard University’s Karen Dynan.

The central bank has already begun debating when the $ 120 billion asset purchase program will begin to shrink, with officials pledging to keep up to 2 percent average inflation and achieve “significant progress” toward full employment.

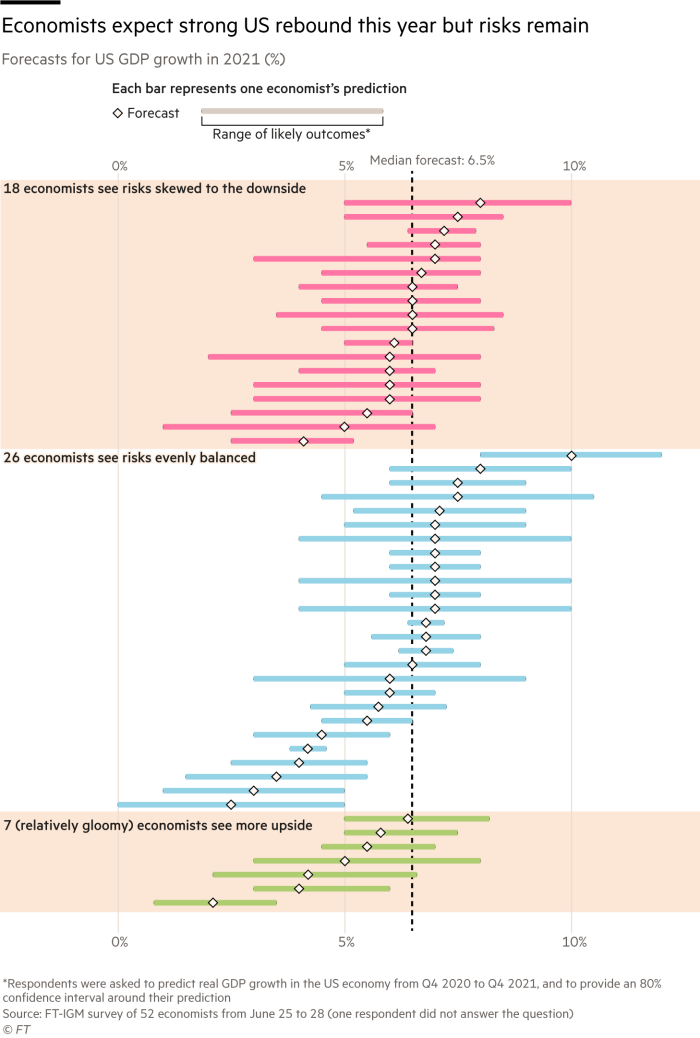

The FT-IGM survey showed significant disagreement with its economic growth forecasts for 2021, even though it has been in the rearview mirror for almost half a year.

The average forecast was a 6.5% rebound in gross domestic product, after last year the economy had a 3.5 per cent contract. But economists were also asked to implement a credible range of results, and these were often distorted in the opposite direction, rather than the other way around.

According to the high level of change, “there is a great deal of uncertainty about how fast service sectors will bounce back, whether labor market shortages will hinder growth or how savings are. [and] Consumption will respond after the fiscal stimulus is marked, ”said Allan Timmermann, a professor at the University of California, San Diego, who helped design the survey.

[ad_2]

Source link