Asset managers are wary of the rise in cryptocurrency prices

[ad_1]

The recent volatility in bitcoin prices caused by Tesla Elon Musk the new fund has created new doubts among managers as an asset class about the future of cryptocurrencies.

UBS Wealth Management, Pimco, T Rowe Price and Glenmede Investment Management were among the companies that have expressed reservations about the potential of cryptocurrency investments in recent days.

Tesla said it would no longer accept bitcoin payments for its electric vehicles because of environmental concerns, and Musk jokingly mentioned dogecoin, a cryptocurrency rivalry. “bustle”In a newspaper appearance Saturday Night Live TV show.

“Our attitude to customers is the rule of the 10-meter pole: get away with it,” said Jason Pride, Glenmed’s major private wealth investor. “I don’t think the Fed and other regulators are fans of the current structure of the cryptocurrency market.”

Rob Sharps, president and head of investment at T Rowe Price, told the Financial Times: “Crypto has an impact on capital markets and we are experts in capital markets. Ultimately, the orders we manage for clients are not very suitable for investing in cryptocurrencies, and speculation in this space we recognize that the level is high. “

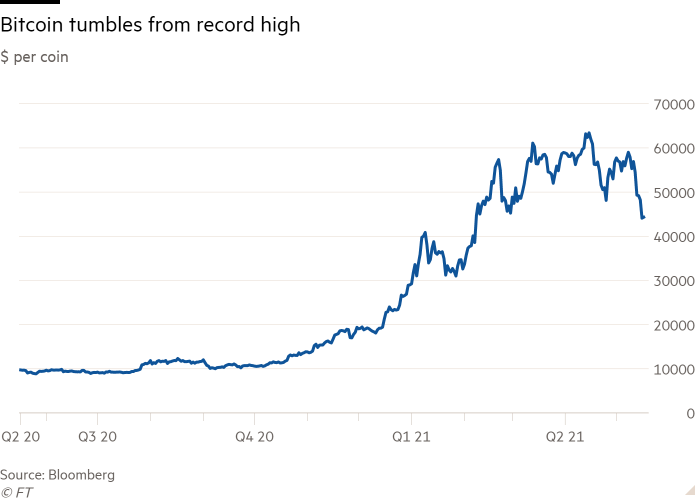

Highlighting the extreme volatility, bitcoin traded at more than $ 44,000 on Monday, about $ 20,000 from a record it set a few months ago. Musk created the latest uproar, which seems to mean that Twitter has or will continue to sell Tesla’s accumulated stake in bitcoin. He later clarified that the automaker “did not sell bitcoin.”

There is no doubt that bitcoin has gained traction in recent years with investors and has become a more liquid trading of futures contracts. U.S. regulators are also considering whether to accept crypto exchange-traded funds.

Asset managers say they are concerned about signs that cryptocurrencies would be less volatile over time or fail to meet investors ’expectations of capital turbulence or inflation.

“The volatility of cryptography is stratospherically high and we often see that when stocks sell, so does bitcoin, which means it’s not a good diversifying portfolio,” Pride said.

Nicholas Johnson, manager of Pimco’s commodity portfolios, took issue with bitcoin advocates, praising it as an inflation paradise while cryptocurrencies fell in price on gold.

“This idea that crypto is an active inflation is strange,” he said. “Inflation assets have not had a good result in recent years while cryptocurrencies have done very well. People are looking for a reason to justify why cryptocurrency has gone up.”

As cryptocurrency anxiety escalated this week, a major U.S. regulator warned investors that buying mutual funds to show bitcoin futures is “a very speculative investment” – and warned mutuals that their involvement with the cryptocurrency would depend on intense scrutiny.

Investment Management Division Securities and Exchange Commission He said: “Investments in the future Bitcoin market should only be done with appropriate strategies that support this type of investment and allow the full emergence of material risks.”

“We expect tougher cryptocurrencies and more regular policies as it becomes more prevalent,” UBS Wealth Management said, adding that the volatility of prices following Tesla’s announcement “highlights the risks that companies take on exposure to cryptocurrencies”.

Tom Jessop, head of digital assets at Fidelity, which has had a better reception of cryptocurrencies, however, warned that these investments were still in the early stages of development.

“We consider bitcoin to be a sufficient repository of securities and it is a teenager because of its extreme volatility in terms of its development,” he said. “Some investors are willing to accept volatility because they see bitcoin as a long-term risk option.”

Fidelity provides a brokerage service to more than 100 institutional investors, such as hedge funds and family offices, to buy cryptocurrencies and provide oversight services. Fidelity has a small fund that invests in digital assets for clients and has asked the SEC to launch an ETF for bitcoin.

Although asset managers are moving away from cryptography, changes in their valuations are a concern of the industry because retailers are gaining increasing power to influence volatility in the equity market, known as the “replacement effect”.

“Seeing what retail investors do is just as important as the bond flows for managers,” said Viraj Patel, an analyst at Vanda Research. “They’re wondering if thousands of years of capital buys bitcoin, does that mean they’ll stop buying high-beta U.S. stocks?”

Weekly newsletter

For FT’s latest news and insights into fintech from a worldwide network of correspondents, sign up for our weekly newsletter #fintechFT

[ad_2]

Source link