Big Tech’s growth surprises Wall Street

[ad_1]

After a boom in the coronavirus pandemic caused by the world’s largest technology companies, it was hoped that life would gradually return to normal.

That is not the case.

Big Tech this week has impressed with growth and profit growth on Wall Street, providing strong evidence that forced digital addiction to a large portion of the world’s population over the past year could have a lasting impact.

Minimum figures have been reset in the business world, some technology investors and analysts have said. According to this view, the major digital powers have consolidated the gains they have made in the last 12 months and have made themselves a more essential part of their work and personal lives.

“It’s been a great season to report on technology for the biggest of the biggest,” said Jim Tierney, fund manager at AllianceBernstein.

The impact of Big Tech in the growing business world can be summed up in just two numbers.

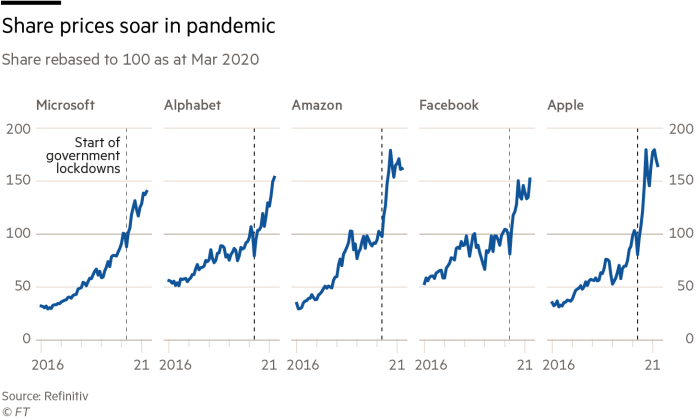

One is the combined revenue of Alphabet, Amazon, Apple, Facebook and Microsoft, which rose 41 percent in the first three months of this year to $ 322 billion. This represents a rapid acceleration of growth that major technology companies have not seen in years, even as they become some of the largest companies in the world.

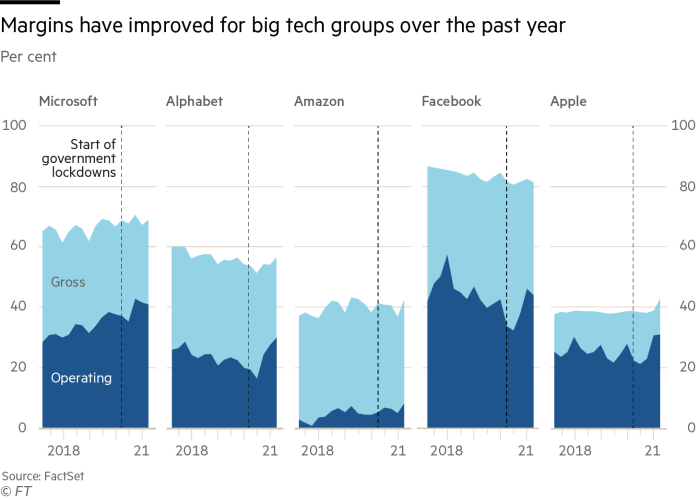

The other is the increase in corporate profits, which is even more impressive. Earnings after the five taxes were up 105% from the previous year, at $ 75 billion. Profit margins rose across the sector as large companies benefited from economies of scale despite being wary of the pandemic cost spread.

Wall Street already had the power to defend technology stocks, believing they were resistant to the downturn, Tierney said. It hasn’t been so understood until the last few days, he added, that Big Tech has also indicated that it is ready for a recession as consumer and business activities increase on their digital platforms.

It’s not the last Big Tech performance compared to a weak quarter of a year ago. With the exception of Apple, they grew by more than 10 percent before the pandemic occurred, although growth rates were slowing.

Based on the impressive financial performance unveiled this week, there has been a subtle shift in the role that Big Tech platforms play in their daily lives, said Gene Munster, an investor at Loup Ventures.

“At one time consumers valued opportunity, but what they value now is reliability,” he said. This has led to more attention and spending being focused on the iPhone, the search engine Google and Facebook as well as popular and easy-to-use platforms like Instagram, habits that were deeply rooted in central screen play. participate in all aspects of life.

Whatever the reason, the first anniversary of the pandemic has been a leap in digital activity and global money making on the largest digital platforms. Unless the world reopens as the reverse does, this has set a new and larger bar for new technologies to be measured.

“The question is, how high is the plateau?” said Brian Wieser, head of business intelligence at GroupM, a member of the WPP advertising team. “It’s definitely bigger than we expected two weeks ago.”

The star activity of the first quarter can clearly be found in a number of areas. Digital advertising, which has been constantly evolving in the form of traditional commercial messages for years, has made a big leap.

The most used mobile and cloud computing platforms, from iPhone to Amazon cloud services, have seen a new explosion of activity. And some cutting-edge technology companies have taken advantage of the extensive use of their platforms to access a wider range of high-profit services.

“In the face of the pre-pandemic, we were seeing the disappearance of the growth of digital advertising – but the pandemic has juggled a lot of things,” Wieser said. The brand’s owners developed a new appreciation of digital advertising during the pandemic as they relied on online sales, he added, as many new businesses created over the past year have naturally turned to online channels to find the market.

Google and Facebook had the highest advertising growth over the years, with Google increasing ad revenue by 32% and Facebook jumping by 46 percent. The jumps come against the recovery in ad markets around the world – even if they exceed the 10 percent rebound expected in the industry this year, according to GroupM.

While time and money are ready for consumers to donate with their most important gadgets, Apple has seen a jump in 66 percent of iPhone sales. The computer market also fell sharply, with unit sales falling by about a third in the first quarter, boosting Microsoft’s profits.

By comparison, the continued expansion of cloud computing platforms led by Amazon, Microsoft, and Google, which have become the backbone of the corporate IT departments, has been less headlined. But the rise in remote work, learning and entertainment allowed the three cloud operators to maintain the growth rates they were recording this time last year, even though they were much higher and suffered some customers during the pandemic.

Meanwhile, technology companies have taken advantage of their deep connection with millions of users to delve deeper into some of the services offered through their platforms. When Apple declined to go to services, once Wall Street found it interesting for its gadgets, its gross profit margin, which caused a jump in profits, reached more than 42 percent, which is a difference of about 38 percent. many neighborhoods.

On the other hand, Amazon’s new services have led to a transformation in the company’s profit profile. This includes growth in the Amazon Web Services cloud platform, as well as advertising, in the company’s “other revenue” category in the first quarter, especially in the ad category, which saw a 73 percent jump.

The result was that the company, which had quarterly profits, was known for its permanent losses. Amazon’s $ 8 billion after-tax earnings were the equivalent of the company’s first full profit for the first 22 years in the quarter.

Among the euphoria on Wall Street was the brief concern about the potential intervention by regulators to reduce the power and profits of Big Tech. In stocks, except for Apple, according to the latest data, they were very high or very close.

There were few other concerns to ruin the party. Tierney said the end of the strong secular growth trends that Big Tech has lifted could happen before too many years have passed. But he added: “How many years can Microsoft grow in the 50 percent cloud business, and how many years can Google advertising grow by 30 percent? There’s still no sign of it hitting the wall.”

[ad_2]

Source link