Democrats are questioning Biden’s plan to tax the rich

[ad_1]

In April 2011, Barack Obama enlisted the help of billionaire investor Warren Buffett to try to convince Congress. imposed at least a 30 percent tax on Americans earning more than $ 1 billion a year. He was rejected by the walls of Republican opposition and skepticism of some moderate Democrats.

Ten years later, Joe Biden continues his own version of the mission with a plan to raise taxes paid even more aggressively to help fund more than $ 1.5 million in health and education.

Tax lobbyists have warned that the Democratic president of the United States will go up another slope, putting the plan in jeopardy for the legislature to fight him in the coming years. There is likely to be an obstacle for Democrats in wealthy neighborhoods in the neighborhoods of New York, New Jersey, California and Illinois, above the predictable Republican opposition.

“Democrats have been reliable and have been sensitive to a relatively rich support base. So overreaction can lead to political attacks and economic problems that could alienate those voters, ”said Mac Democrat, a former Democratic aide to Congress and vice president of the Lincoln Policy Group lobby company.

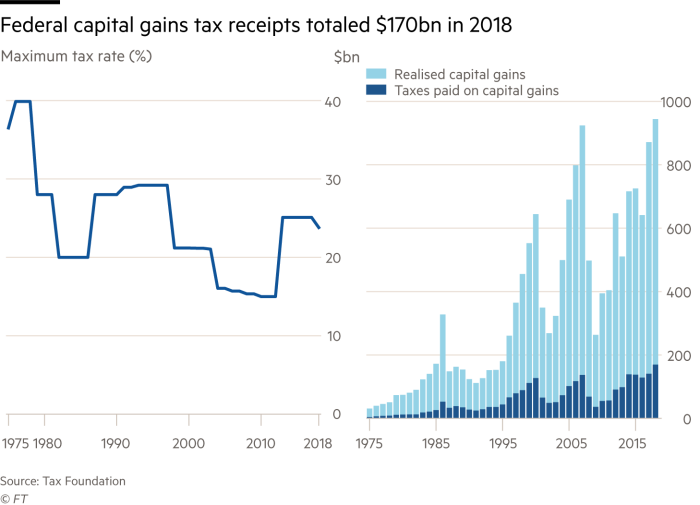

The Biden administration plan is expected to nearly double the tax rate on Americans earning more than $ 1 billion in profits and dividends a year, as well as raising the highest income tax rate to 39.6 percent. The moves would hurt wealthy investors, including hedge fund managers and private equity executives.

The White House has seen a major shift in popular opinion in favor of higher taxes for the wealthy, with high incomes after the financial crisis and good results during the coronavirus pandemic, while low-income families struggled.

But the White House has already received a taste of resistance: some Democratic lawmakers are working hard to overthrow Biden hat About the federal deductions for state and local tax payments made by former President Donald Trump. The policy has increased costs for homes in Democratic strongholds like New York, New Jersey and California.

“Democrats in states with high taxes and living costs have been targeted by laser to abolish the state and local tax deduction limit. The president’s team will have to direct or direct an affirmative action policy if rich Americans are to succeed in raising capital gains taxes,” said Democratic strategist Izzy Klein and One of the founders of the Klein / Johnson Group, a firm bilateral lobby.

Biden certainly has a better chance of raising taxes on the wealthy in 2011 when Republicans gained control of the House of Representatives and blocked many of their economic policies.

But Biden can only count on the smallest democratic majorities in the House and Senate.

“It’s going to be hard to keep everyone on board,” said one Democratic tax lobbyist. “I think the administration is being very aggressive, which is probably at the service of their interests, but I’m not sure Congress will be so aggressive in the end. You’ll probably see the modulation of what is done in the end.”

Matt Bennett, one of the founders of Third Way, a centrist Democratic Democrat, said he believed the “intra-democratic engagement” would almost certainly happen.

“One of the things that Biden has done a pretty good job of is that in this country we don’t do a very good job of providing a rewarding job with public policy, and equalizing the way we make money and the non-profit ways,” he said. “That’s a pretty compelling set of arguments that resonates a lot.”

Renowned business groups have questioned the capital gains tax proposal, but that goes beyond the Biden expansion plan corporate taxes $ 2 million to pay for an infrastructure proposal. Suzanne Clark, director of the U.S. Chamber of Commerce, told CNBC that the supply of capital gains is “appalling” and said the influential business lobby will campaign against it.

“Right now the idea that we would punish people for investing in the economy seems horrible. I don’t think Congress can get past that and we’ll make sure of that,” he said.

Etxe Zuriaren argudioari buruz galdetuta, zerga igoerak AEBetako etxeen% 0,3 aberatsenari bakarrik eragingo liokeela, Clarkek esan du ekonomian eragin zabalagoa izango duela. “Kezkatzen gaituzten datuak enpresa publikoetan egiten duten inbertsioarekin zer egiten duen da [and] what does that do with middle-class pensions, ”he said.

A quieter tone appeared from the Investment Company Institute. The fund group traders’ association said it would look into the proposal as it developed and added, “With tax policy, the devil is always in the details.”

Some investors asked Washington to maintain different tax treatment for capital gains, considering how long they held before the securities were sold.

Colin Moore, chief investment officer at Columbia Threadneedle Investments, said he expects wealthy investors to increase their sales of high-yielding stocks next year. However, equity markets have risen to a record high as the probability of higher capital gains and corporate tax rates increases.

“You certainly have taxpayers who are looking at a huge increase in the capital gains tax rate and if I were to make a profit that I would soon recognize in the next six months or a year, do I mean? In that bath?’ ”Said Rohit Kumar, PwC’s Washington tax the main leaders of the national services team.

As the debate begins on Capitol Hill, Democratic lawmakers are at least coming together on the idea of improving funding to better enforce the Internal Revenue Service’s tax code, which they say could generate $ 700 million in revenue in 10 years. West Virginia, a moderate Democratic senator from West Virginia, told CNN on Sunday that the option “should be explored before taxes begin to rise exponentially.”

After Obama hit the roadblocks in 2011, after re-elections in 2012, he managed to push for higher rates of income tax and capital gains. In 2021, hope is growing on the left wing of the Democratic party that Biden can follow his plans. , although it has not accepted a bolder proposal on the estate tax.

“The tax system is fairer to make our country better and stronger,” Massachusetts Democratic Sen. Elizabeth Warren said Wednesday. “The opportunity to invest in our economy is to ask the richest Americans and the largest corporations to pay their fair share.”

[ad_2]

Source link