Stablecoin conflicts: Cryptographic assets require tougher oversight

[ad_1]

The Stablecoin market, a crucial link between cryptocurrencies and traditional currencies, requires stricter oversight, as regulations on both sides of the Atlantic lag behind the rapid growth of digital assets.

Stablecoins says the trading port is safe for traders to store funds, making it a major part of cryptocurrency trading as money used by typical investors in market funds.

Patches on disclosure standards, lack of consumer protection, and the role that money can play in a more traceable way have intensified the call for more rigorous surveillance as the market has expanded along with the broader digital asset industry.

“The direction of the trip is certainly to regulate them,” said John Salmon, who leads the Hogan Lovells law firm’s blockchain and cryptocurrency practices.

All political leaders in the US, the UK and continental Europe are growing plans to oversee stablecoins, which are “tied” to traditional currencies, commodities or other digital assets to reduce volatility. Most Stablecoin issuers say their coins are fully protected with reserves, usually traditional currencies or cryptocurrencies.

A group of U.S. members of Congress at the end of last year proposed legislation stablecoin issuers would need to obtain a bank letter, comply with banking regulations, and have the approval of the Federal Reserve and the Federal Deposit Insurance Corporation.

“Digital currencies, because their value is linked to or stabilized by a common currency such as the dollar, create new regulatory challenges [they] they represent a growing source of market, liquidity and credit risk, ”said Rashida Tlaib and Stephen Lynch of the House of Representatives.

What is a stablecoin?

Stablecoins are cryptocurrencies that are associated with another asset, theoretically reducing their volatility. This stability makes them useful for converting currencies between currencies and other cryptocurrencies.

Stablecoins can be associated with asset classes such as physical currencies, currency baskets, other cryptocurrencies and even real estate.

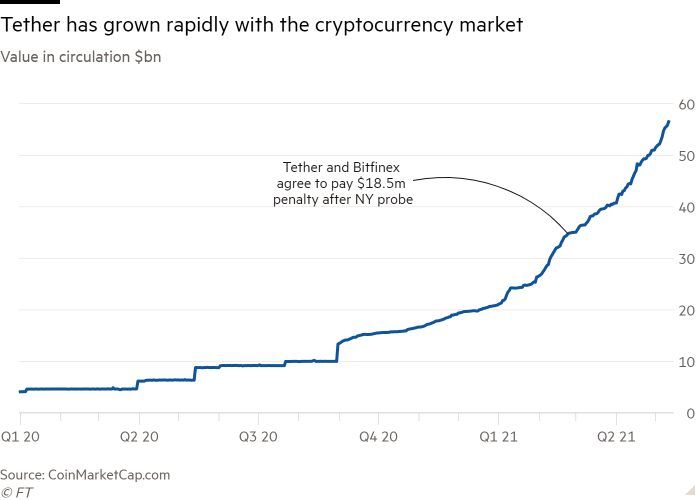

Tether, launched in 2014, is the largest establishment in circulation, with $ 56 billion in coins. The Facebook-sponsored stablecoin, Diem (formerly known as Libra), could be launched this year.

Rohan Gray, a law professor at Willamette University, who helped with the writing invoiceHe added that “there is a long history of new entrants into the financial sector using the technological advantage….

“Everything [the variations of stablecoins] they are just shadow banks that should be regulated for me. . . as part of the banking system, ”he said.

Harry Eddis, a partner at Linklaters law firm, spoke about the European Commission’s Crypto-Assets proposal and the UK Treasury on stable consultations, both of which call for greater regulation of the sector and highlight the ambiguity surrounding the stablecoins situation.

“If a stablecoin falls into the category of unregulated or electronic money, a lot of regulatory oversight and conduct rules fall,” Eddis said. “That’s why you see a lot of regulators who want to enact regulations.”

Last June, the Financial Action Taskforce, which sets global standards for money laundering and terrorist financing, released draft report stablecoins to the G20 nations team. He noted that asset stabilization mechanisms can present ways to manipulate the market.

The regulatory debate is that when many investors in the crypto market are looking at Tether, it is the largest establishment with about $ 56 billion in circulation, according to CoinMarketCap.com.

Stablecoin – $ 1 is “tied” to the focus, in part because it has continued to operate in many jurisdictions and has grown rapidly even after censorship by New York’s attorney general.

The state attorney general said in February that it was a “lie” that Tether’s virtual currency was fully protected with U.S. dollars at all times. ”Tether and Bitfinex members were fined $ 18.5 million for complaining about reservations and“ covering massive financial losses ”. In a 2018 incident.

The groups were also ordered to report quarterly, what types of assets are being used to repossess Tether coins, and a ban on operating in New York was imposed.

“These companies hid the real investment risks and were managed by unlicensed and unregulated individuals and entities operating in the darkest corners of the financial system,” said New York Attorney General Letitia James at the time. The group said the issue “does not support wrongdoing.”

Tether now says his coins are “fully” backed by the company’s reserves, but has provided poor details about the mix of assets he owns that may include “traditional currency” and “receivables from third-party loans made by the chain”. parties ”.

“They don’t have it yet [released] this [information] it’s very late in the game, but throwing away $ 50 billion in coins is very absurd, ”said Tim Swanson, founder of technology consulting firm Post Oak Labs.

Tether and some large stablecoin issuers, such as the USD Coin backer Circle, publish what third-party accountants call “credentials” to provide a level of knowledge on their holdings. However, these statements may differ from the usual audits in terms of what they disclose, and there is a wide variety among companies.

“As the most reliable digital currency in the dollar in circulation, Circle remains committed to USD Coin’s high standards of transparency and accountability,” the spokesperson said.

Amy Kim, chief policy officer of the Digital Chamber of Commerce’s industry group, said that if companies took a “more unified approach” it would “create consumer confidence and help the industry grow responsibly”. Last week, the group released a report suggesting a standard of cohesion to address “unbalanced and consistent methods”.

Stablecoins also faces the long-term challenge of digital currencies in central banks, offering a separate digital payment system to commercial banks and payment companies.

Among the various proposals, individuals are allowed to hold digital accounts at a central bank or digital token.

“This is going to be a big geopolitical debate over the next decade,” said Jonathan Knegtel, one of the founders and CEO of the blockchain company Blockdata. “Will regulators be comfortable with the central bank’s digital currencies along with stablecoins?”

[ad_2]

Source link