Why is the fear of Wall Street so low?

[ad_1]

After shocking investors with inflation fears in the first months of 2021, the markets have changed in a different way: deep drowsiness.

Vix, the expected measure of volatility in the Wall Street S&P 500 equity index, fell in the 15.7-point pandemic era on Friday, rising more than 80 in the early stages of the pandemic. The volatility measure in the foreign exchange markets produced by Deutsche Bank also fell to its lowest point since February 2020 last week.

Analysts say the quiet period partly reflects the Federal Reserve’s wait-and-see tactics, which is without removing funding to prepare for an extraordinary inflation surplus. Withdrawal from this would disturb the markets. But some investors are getting nervous because of the fact that it is creating a nice one.

“We feel more and more alert” about the calm conditions of the stock markets, said Gergely Majoros, a member of the investment committee of European fund manager Carmignac. “It means you have to keep your eyes open for the next one.”

In a research note, the investment bank of the Swiss bank Credit Suisse warned that it has a “high level of investor friendliness” in its asset markets, suggesting that it “has a higher-than-usual risk of news flows”.

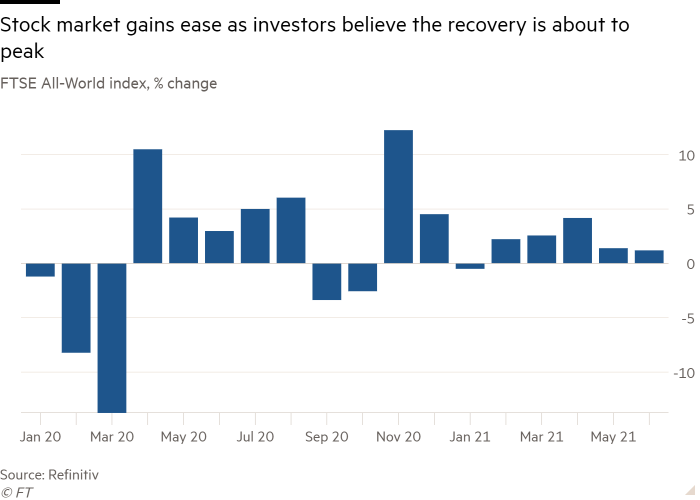

The global stock has risen as the economies of developed countries have recovered from the coronavirus emergency to improve corporate profits. Earnings have been quiet in recent weeks, and some investors have said the good news has been around for a long time. The stock of FTSE All World developed and emerging markets gained more than 1.4 percent this month.

US consumer price inflation was up 5% in the 12 months to May. 4.2 percent economic prices rose again in April and supply chain bottle caps (such as used cars and raw materials) reopened rose.

Central banks have traditionally tightened financial conditions to cope with rising prices. But the Fed, which meets this week, has maintained that the inflation outbreak is temporary. It has also managed to convince many investors.

“The markets agree, at least for now [Fed chair Jay] Powell is seeing inflation as transient, ”said Margaret Vitrano, portfolio manager at ClearBridge Investments.

A survey of 207 global fund managers responsible for $ 645 billion in customer assets at Bank of America this week showed that more than seven in 10 believe that post-pandemic inflation would be transient. Many have already reduced their bond holdings in the hope of lighter support for Fed in this market in the future, as they have moved the bond portion of their portfolios to a minimum of three years. The negative attitude towards the bonds was another factor that convinced the asset managers to hold the shares, investors said.

“Shares are expected to rise this year, but not at the same pace as activity was accelerating earlier in the year,” said UK investment director Caroline Simmons at UBS’s wealth management sector.

Low volatility is not always a sign of selling shares, historical data show. Data collected by Duncan Lamont Schroders analysts showed that buying the S&P 500 Vix on the day between 1991 and 1991 would bring a 14.6 percent return over the next 12 months.

Analysts said they were saddened by the sentiment that could break the sentiment in the markets if inflation were to fall short of the Fed’s expectations.

“Sustainable inflation is a higher entry cost that companies can’t exceed… Because household food and energy costs are also higher, which really affects profitability,” said ClearBridge’s Vitrano. The stock markets were “crushing water,” he said. because it’s too early to call. ”

Currency markets have also come to a standstill by keeping financial conditions free for longer than the Fed initially expected traders.

The dollar index, which measures the U.S. dollar against the currencies of trading partners, has risen less than 1 percent this year after consolidating in the first quarter and then yielding the biggest gains.

“The main story of inertia [currencies] it’s pretty straightforward, and underscores the difference between the undeniable power of U.S. reflection and the immovable object of ultra-patient food, ”said Paul Meggyesi, head of global FX strategy at JPMorgan.

The Conference Board predicts that US economic output will grow at an annual rate of 9% in the second quarter of this year, after which it will moderate. Business profits are expected to follow a similar trajectory.

Analysts predict that the profits of companies listed on the S&P 500 will increase by 35 percent this year, falling to a 12 percent gain in 2022, according to FactSet. At Stoxx Europe 600, profits are expected to increase by 51 percent this year and by 14% in 2022.

“The only direction the Fed and other central banks can take now is to reduce accommodation, which could lead to correlation shocks,” led to rising bond yields, said Olivier Marciot, a cross-asset investment firm at Unigestion. “The markets are in a position to wait and see. It’s not about what’s going to happen but when… If you move too early in the game you’re going to be beaten.”

[ad_2]

Source link