The Chinese port company has warned that Australian revisions increase sovereign risk

[ad_1]

A 99-year-old Chinese company with a 99-year lease in the port of Darwin has warned that the treatment available to the Australian government risks scaring away investors from other countries.

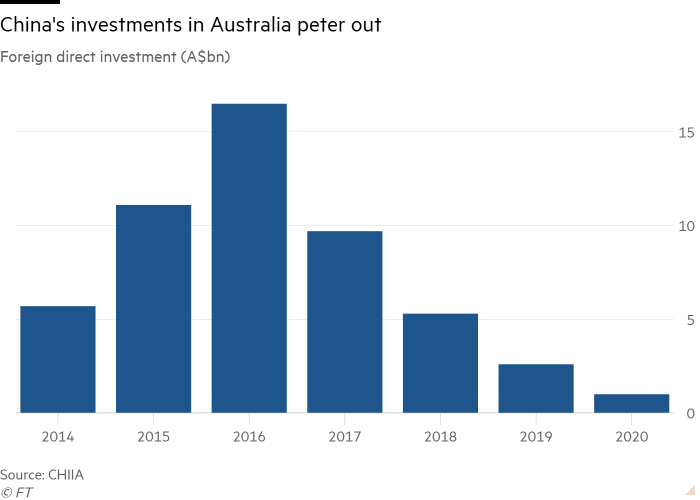

Landbridge, a Shandong-based company founded by billionaire Ye Cheng, was last month informed of a security review of operations in the Northern Territory, which in 2015 bought $ 506 million ($ 380 million). The development was severely damaged by relations between Canberra and Beijing fall In 2016, Chinese companies invested in Australia, earning $ 16.5 billion in revenue.

“My problem is as a foreign investor, when the government accepted us, we had a very painful time [review] and for five years no one has come up with anything specific to know what the problem is, ”Mike Hughes, Landbridge Australia the managing director told the Financial Times.

“We are not a Chinese government, we are a private company. If we were to force the study to sell the port lease, it would certainly raise sovereign risk for foreign investors looking to Australia, not just Chinese investors. ”

It’s a tough debate discussion Among Australian security hawks and pro-business forces. The latter are concerned that the decision to force Landbridge to sell the lease threatens foreign investment.

It is dangerous for hawks to allow a Chinese company to control vital Asia-Pacific infrastructure.

The group, made up of 15 right-wing MPs, is run by China Merchants Group, a state-owned company in the port of Newcastle, the world’s largest coal port with a 50 per cent stake. Last week the group called on the government to take a closer look at the port, saying that the interest had “given the Communist Party of China a geopolitical advantage over Australian coal exports”.

As the interest in Chinese investment has increased, the opposition Labor Party has criticized how the Conservative government has handled Sino-Australian relations, arguing that it sparks “nationalist sentiment” for electoral gains.

“The conflict, the federal debate over trade revenge, needs to be stopped and carried out,” Mark McGowan, the prime minister of the state government led by Labor in Western Australia, said last week.

In May, Canberra announced that this was the case reviewing whether to dismantle the conflicting charter of the port of Darwin, in a sparsely populated northern Australian town near a U.S. Navy base. In April, it was decided to suspend the two Belt & Road Initiatives between Victoria and Beijing, the focus of President Xi Jinping’s foreign policy.

“It’s my thought when the decision was made in 2015 [on the port lease] the circumstances were very different than in 2021, ”said Australian Defense Minister Peter Dutton when announcing the review.

The decision to lease the port of Darwin to Landbridge raised concerns in Washington, where the Australian Institute for Strategic Policy, the research team, complained that Landbridge had links to the People’s Liberation Army and the Communist Party. Landbridge says it is a commercial entity and that criticism is unfair.

Many analysts believe the government will demand changes in rents.

“Canberra, for example, can make renting subject to safety reviews every six months,” said Richard McGregor, an analyst at the Lowy Institute. “Or they could take a nuclear option, which would also be expensive and dangerous to completely dismantle the lease.”

McGregor said Beijing will almost certainly dominate, even if it restricts similar Australian investments in China. Penalties have already been imposed on many Australian exports.

“Revenge decision-making will introduce a new sovereign risk for foreign investors is less than Australian,” McGregor said.

Chinese companies have been cautious about the deals in Australia because of the greater scrutiny of the agreements and the distortion of bilateral ties. Chinese investment fell 61 percent According to the Australian National University, the budget for 2020 is $ 1 billion, up from $ 2.6 billion a year earlier.

Hughes of Landbridge said the forced divestment jeopardized Asian investment in Australia.

“It is clear that if you are a US company, you will not be bothered by this. But, you know, foreign investors from other countries, who knows how things can change in a decade or more, ”Hughes said.

Analysts are divided that a breach of the Darwin port lease would significantly change the environment of sovereign risk for companies outside China.

“In the case of Darwin Port, special and foreign factors are at stake,” said Jeffrey Wilson, research director at the Perth USAsia Center.

However, business leaders are demanding caution and are pressuring Canberra to re-establish relations with China, the nation’s largest trading partner of $ 251 billion in both directions 2019-20. If some concerns violate the port’s lease, it could damage bilateral ties and strain foreign investors.

“There will be consequences beyond China,” said Andrew Robb, a former Australian trade minister who oversaw the negotiations on a China-Australia free trade agreement reached in 2015.

Robb, who served as a paid consultant for Landbridge and other Chinese companies when he left the political office, said Canberra had every right to reconsider port leases given the changing strategic situation.

But he warned that Australia-China political relations have “turned to flannel” and that business ties can continue.

“In some cases the tone has not taken into account the sensitivity of the Chinese,” Robb said. “There are certain things that have been going on around China for thousands of years, such as saving face.”

[ad_2]

Source link