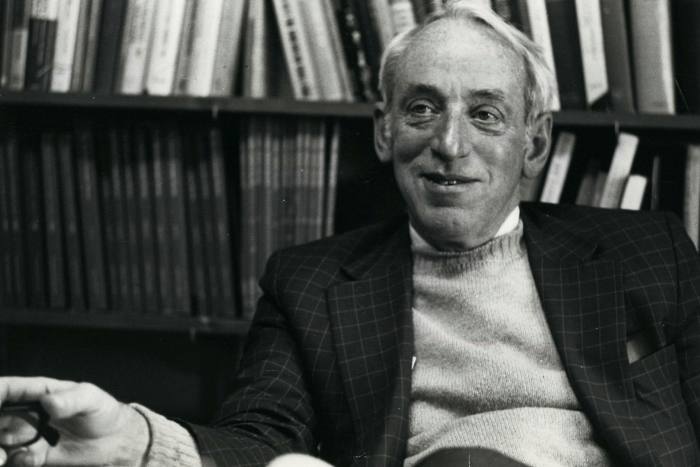

David Swensen, the pioneer of Yale who remodeled investments

[ad_1]

On monday David Swensen despite a long battle with cancer he gave a regular class on investing at his beloved Yale University. Two days later, he finally managed to make some of the biggest money he did, 67 years old.

The investment industry has produced more than just direct and ruthless tycoons, unfortunate failures, and foolish fraudsters. In Swensen (who has run a $ 31 billion endowment for his alma mater since 1985), he had a rare asceticism when he transformed the seemingly wealthless management of the industry.

“They are great painters who change how others paint, just like Picasso. David Swensen has changed the way everyone involved in investing thinks about investing, ”he says. Charles Ellis, He directed Yale’s endowment between 1997 and 2008.

“The results were wonderful, but they were organized to no surprise,” Ellis added. “If you see a great cook cooking in the kitchen, you know the meal is going to be good.”

Swensen he never achieved the fame of Warren Buffett, Peter Lynch or Jack Bogle, but he is highly regarded among industry insiders at their level. Ted Seides, former colleague and a a book on asset distributors, describes his former leader as an undisputed AHAT – the greatest of all time.

“Constantly new ideas, new structures, new approaches were coming to him,” he says. Seides says his investment success is also under his broad influence. “The (Yale) model itself is so unique that almost everyone who worked at the Yale endowment ended up being successful. They’re like Goldman Sachs or Tiger Management for the endowment world.”

Like many great careers, Swensen was unlikely to start. When he first approached Yale University in 1985, he initially thought it would be a teaching job that would not lead to a $ 1.3 million endowment. After all, he was only 31 at the time, immersed in economic theory, but unfortunately he didn’t know how to invest.

The endowments are sets of money from wealthy donors – mostly alumni of the university – that are channeled at the expense of staff salaries, pay scholarships, or maintain school buildings and athletics programs.

Investing for beginners

After earning a doctorate in economics from Yale in 1980, Swensen presented a dissertation on valuing corporate bonds for promising financial careers. He helped structure the first ever Salomon Brothers (an example of the shameless and fast-paced Wall Street of the 1980s) exchange of interest rates, Between the World Bank and IBM. But he had no experience in the investment industry itself.

However, when Yal called, he accepted an 80 percent pay cut and took the job. The route was then taken to help reshape the broader investment landscape by transforming venture capital, hedge funds and private equity industries. Being a beginner proved to be a blessing to the Swedish practice from traditional practice.

At the core of what has been called the “Yale model” are the principles Swensen learned from his tutor James Tobin.

© Alamy

Tobin’s main work on the importance of diversified investment – based on Nobel Laureate Harry Markowitz’s “modern portfolio theory” – was when Swensen married a much longer investment time horizon than normal for supplies.

The model specifies a much higher exposure to unstable stocks (but with longer-term yields), spread across public and private markets, to reduce risk. For Swensen and Yale, this means putting newborn hedge funds, private capital and venture capital into the money industry, as well as real estate and, in the end, dark niches like wood.

The practice now established that this view of asset allocation was tremendous at the time. The Yale model arrived when most universities then took the standard portfolio of stocks and bonds – often with an unimaginative 60:40 split – and there was no endowment worth seeing in the investment world.

Swensen opened the revolution, and eventually the endowment money went into “alternative” investments that were the care of wealthy heirs and wealthy tycoons, transforming the hedge fund, venture capital, and private equity industries into a process.

The results were stellar. The Yale Investment Office It has managed $ 31.2 billion since June 2020 – an average annual return of 12.4% over the past three decades – and contributes more than a third of the university’s budget.

Although Swensen was not the only architect of this model, he is credited with perfecting it. He also made it known that an army of acolytes was repeating its vision in U.S. funds and allotments.

Swensen said she had a “curious ability to identify investment talent,” said Paula Volent, who over the past two decades has directed a $ 1.8 million endowment at Maine’s Bowdoin College and worked at the Yale investment office throughout her career. “It was key to changing our lives a lot.”

Vanderbilt Hall is located at Yale University © Craig Warga / Bloomberg

Poker hands

His passion for teaching was not limited to lecture theater. After long investment meetings, he played poker deep into the night with his investment office staff, not for a lot of money, but for the game. In their hands, they would chew on the investment problems that arose that day.

“He understood the value of the opportunity intuitively and was also not afraid to act very aggressively when the odds favored him,” he says. Robert Wallace, Swensen hired him as an intern when he was a Yale graduate in his 30s, after pursuing a career in professional ballet, studying economics.

Wallace worked for Swensen for five years before running a family office and then went on to manage a $ 29 billion endowment at Stanford University. But he still remembers those poker nights. “I think I learned from David like I did in formal meetings in conversations on the poker table,” he says.

For those not at the poker table, Swensen’s 2000 magnum opus, Pioneering portfolio management, allowed them to absorb their investment philosophy.

Wrong adaptation of Wall Street

At Partners Capital, A $ 40 billion investment group that manages money for endowments and charity, is bound to read the book for new hires, and its founder Stan Miranda paid tribute to Swensen’s influence.

The book was “a masterpiece of investment literature,” he wrote to staff in a note. “(It’s) a powerful model for managing long-term institutional portfolios.”

Swensen was born in 1954 in River Falls, Wisconsin. His father was a professor of chemistry at the University of Wisconsin and his mother a Lutheran minister. he helped settle More than 100 foreign refugees there. His background may explain why he never went to investment banks.

“I liked the competitive aspects of Wall Street, but – and I’m not making judgments worth it here – it wasn’t the right place for me, the end result is because people are trying to make a lot of money themselves,” Swensen once said. Yale Alumni Magazine. “That doesn’t suit me.”

He still received a lavish reward: in 2017 he paid $ 4.7 million, and Yale became the highest paid employee. Certainly his investment genealogy could have made money. If Yale had managed a hedge-sized hedge fund – and with its returns – Swensen would probably have been a billionaire.

Friends and colleagues expressed their devotion to Yale athletics, the fierce competitiveness of the supply-rich softball team “Stock Jocks,” and their usual polite actions. When Tobin’s legs began to fail, Swensen began removing snow on his tutor’s porch every day during the cold winters of New Haven, Ellis recalled.

Now the question is who can follow Swensen – or who can really do it. Miranda thinks that the Yale Model will “become like a work of art, that it will get a higher rating after the artist has passed.”

The following is natural Dean Takahashi, A longtime former lieutenant in Swensen, who now leads a climate change initiative at Yale. But Ellis warns that the challenges any investment official may face are far greater than when Swensen took office in 1985, with high stock valuations, a record low interest rate, and the pioneering Yale models copied around the world – with varying successes.

“I wouldn’t want to be the second person in David’s job,” Ellis says. It’s a feeling that many of his friends and colleagues feel. “David may have a successor, but not a replacement,” Wallace says. “He was the only one.”

Swensen has a wife, Meghan McMahon, three children and two children.

[ad_2]

Source link